As January 2026 unfolds, many taxpayers across the United States are closely watching their bank accounts, hoping to see a direct deposit from the Internal Revenue Service. Social media posts, blog headlines, and forwarded messages continue to circulate claims about a mysterious $2,000 IRS payment arriving “any day now.” For people who rely on tax refunds early in the year, these claims can create both excitement and confusion. The reality, however, is more grounded and far less dramatic than the rumors suggest.

Understanding IRS direct deposit timing requires separating fact from speculation. While there is no new universal stimulus payment approved for January 2026, many filers will still see deposits around the $2,000 mark once tax season begins. The reason these deposits arrive sooner for some and later for others comes down to one critical detail that often gets overlooked: how smoothly the IRS can verify your information.

Table of Contents

IRS Direct Deposit Status Updates in January 2026

IRS direct deposit status updates in January 2026 are closely tied to the start of the 2026 tax filing season. Once the filing window opens, the IRS begins accepting and processing 2025 tax returns. Taxpayers who file electronically and choose direct deposit usually receive refunds faster than those who file by mail or request paper checks.

The key thing to understand is that these January updates do not signal a special relief payment or bonus program. Instead, they reflect routine refund processing activity. Refund amounts vary by individual, but the $2,000 figure appears frequently because of how common certain tax credits and withholding patterns are among working households.

IRS Direct Deposit Status Overview Table

| Category | Details |

|---|---|

| Payment Type | Regular 2025 tax refund |

| New $2,000 Stimulus | Not authorized |

| Filing Method | E-file with direct deposit is fastest |

| Common Refund Amount | Around $2,000 for many filers |

| Main Timing Factor | Identity and banking verification |

| Tracking Tool | IRS “Where’s My Refund?” |

No New $2,000 Stimulus Payment Has Been Approved

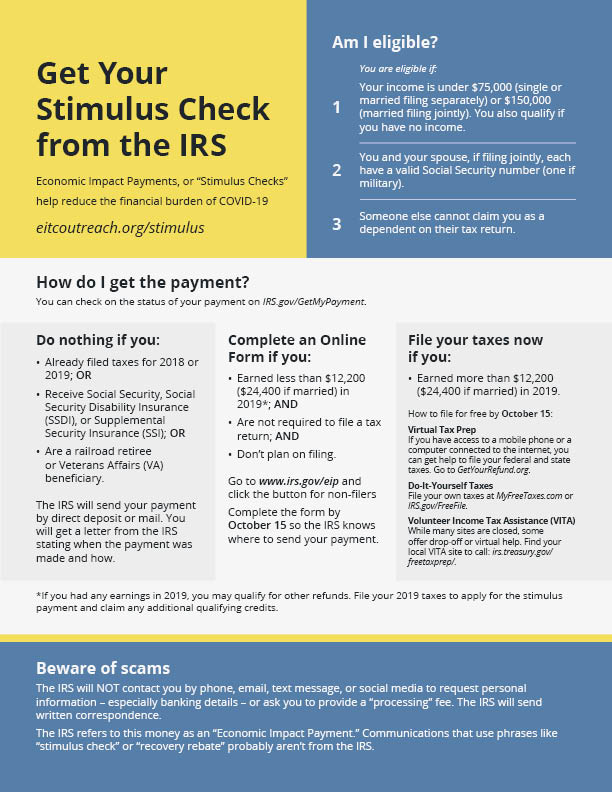

Despite persistent headlines suggesting otherwise, there is no new federal legislation authorizing a blanket $2,000 stimulus payment in January 2026. Neither Congress nor the Treasury Department has announced a new round of economic impact payments. Any claim stating that all Americans are guaranteed a $2,000 IRS deposit this month is inaccurate.

This misunderstanding often grows from a mix of outdated stimulus discussions and click-driven content. In previous years, stimulus payments were widely publicized and formally announced by the government. In contrast, no such announcement exists for 2026. The IRS has made no statements confirming a new nationwide payment program.

Why Many Refunds Still Land Near $2,000

While there is no special stimulus, many taxpayers will still receive refunds close to $2,000 once their returns are processed. This is not a coincidence. Several common tax factors naturally produce refunds in that range.

Refundable credits like the Earned Income Tax Credit and the Child Tax Credit significantly increase refund totals for eligible households. Additionally, many workers have more federal income tax withheld from their paychecks than they ultimately owe. When that excess withholding is returned, it can easily push refunds into the low-thousands range.

Because these situations are so common, the $2,000 number keeps reappearing, fueling the misconception that it represents a special payment.

The One Detail That Determines When Your Deposit Arrives

The most important factor affecting direct deposit timing is verification. When the IRS processes a return, it checks identity details, dependent information, and banking data against its records. If everything matches cleanly, the refund usually moves through the system quickly.

However, even minor changes can slow things down. A new bank account number, an updated mailing address, recently added dependents, or prior identity theft flags can all trigger extra review. These safeguards exist to prevent fraud, but they can delay refunds even when the return itself is accurate.

In simple terms, taxpayers with unchanged information and a clean filing history are more likely to see faster deposits than those whose details require additional confirmation.

What January Refund Timing Usually Looks Like

January is an early phase of the tax season, and refund timing varies widely. Once the IRS begins accepting returns, electronically filed submissions that pass automated checks can be processed within a few weeks. Direct deposit refunds are typically issued sooner than paper checks.

Returns involving certain credits or verification steps may remain in a pending status longer. This does not necessarily mean something is wrong. It often means the return is undergoing routine review. For many filers, refunds arrive in February rather than January, even when everything is filed correctly.

How to Track Your IRS Direct Deposit Refund Safely

The safest and most reliable way to monitor your refund is through official IRS tools. The “Where’s My Refund?” feature provides real-time status updates once a return is accepted. Third-party websites and viral messages should be treated with caution, especially those promising guaranteed payment dates.

It is also important to remember that the IRS does not contact taxpayers through unsolicited texts, social media messages, or emails offering money. Messages asking for personal information or urging immediate action are common phishing tactics and should be ignored.

Direct Deposit vs. Paper Checks

Direct deposit remains the fastest way to receive a tax refund. The IRS continues to encourage taxpayers to use electronic filing paired with direct deposit to reduce delays and errors. Paper checks take longer to process and are more susceptible to mailing delays.

Taxpayers who want quicker refunds should double-check routing and account numbers before submitting their return. Simple mistakes can cause significant slowdowns or require reissued payments.

Final Thoughts: Clearing Up the January 2026 Confusion

The discussion around IRS direct deposit status updates in January 2026 has been clouded by misinformation. There is no new $2,000 stimulus payment being sent to all taxpayers. What many people are seeing—or expecting to see—are standard tax refunds that often fall around that amount.

The real reason timing differs from one person to another is verification. When personal and banking details match IRS records without issue, refunds tend to move faster. When they do not, delays are common but usually temporary.

For the most accurate information, rely on official updates from the Internal Revenue Service, file early if possible, and make sure your information is accurate. Doing so won’t create a special payment—but it can help ensure your refund arrives as smoothly and quickly as the system allows.