Searches for the $725 Monthly Program surged across the United States in January 2026, fueling speculation that a new federal cash benefit had launched. Government agencies and policy experts say no such nationwide program exists. Instead, the spike reflects a convergence of local income pilot programs, seasonal financial pressure, and widespread confusion over how government payments are distributed.

Table of Contents

What We Know About the $725 Monthly Program

| Key Fact | Detail |

|---|---|

| Federal program exists? | No universal federal $725 Monthly Program |

| Why searches spiked | Viral posts, January financial stress, local pilots |

| Who may receive $725 | Limited participants in local or targeted programs |

| Risk to public | Increased misinformation and scams |

Why Searches for the $725 Monthly Program Are Rising

The sudden rise in interest surrounding the $725 Monthly Program is not occurring in isolation. January is consistently one of the most active months for financial searches in the United States. Households review spending after the holidays, check bank deposits, prepare tax documents, and look for financial relief.

Search analysts say this seasonal behavior often magnifies attention to any claim involving monthly payments or government assistance. When a specific dollar amount is repeated frequently online, it gains credibility through familiarity, even when official confirmation is absent.

Short-form social media posts referencing “$725 monthly deposits” have circulated widely, often without clarifying who qualifies, where the money comes from, or whether the program is federal, state, or local.

No Nationwide Federal $725 Monthly Program

Despite online speculation, there is no federal law, executive order, or agency announcement establishing a universal $725 Monthly Program for all Americans.

Federal payment systems, including Social Security, veterans’ benefits, disability insurance, and tax credits, operate under strict eligibility rules. Monthly payment amounts vary based on income history, household composition, and legal status. No current federal policy distributes a flat monthly payment of $725 to the general population.

Policy analysts say confusion often arises because legitimate government payments can arrive via direct deposit labeled as “federal,” even when they are unrelated to new programs.

Where the $725 Figure Comes From

Local Guaranteed Income Pilot Programs

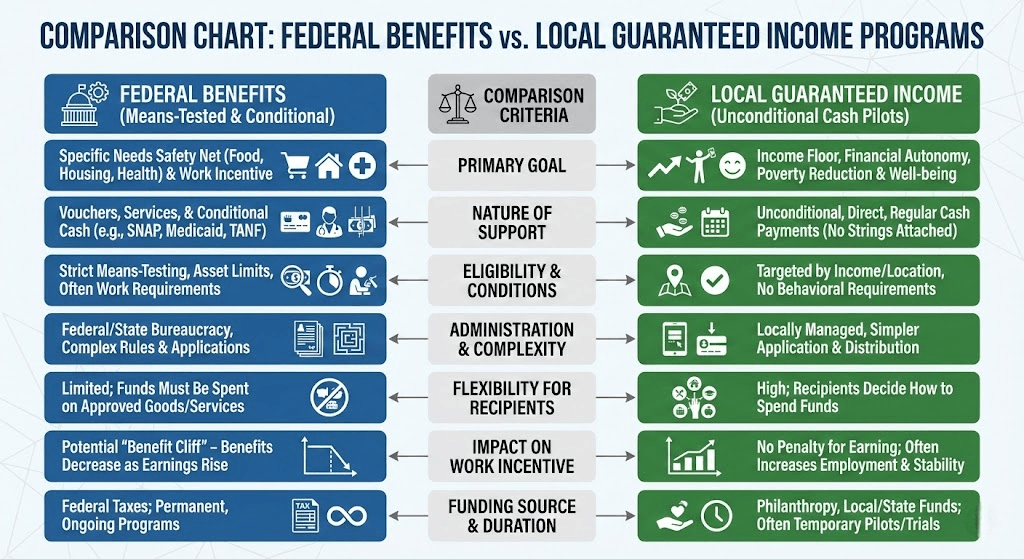

Across the United States, many cities and counties have launched guaranteed income pilot programs. These initiatives provide direct monthly cash payments to a limited number of residents, often to study financial stability, employment outcomes, or health effects.

The payment amounts in these pilots vary, but many fall within the $500 to $1,000 range. In several cases, monthly payments have been set near $725, making the figure both realistic and easily misinterpreted when taken out of context.

Participation in these programs is typically restricted by geography, income level, family status, or random selection. They are not permanent and are often funded through grants, philanthropic organizations, or local budgets.

Targeted Assistance Programs and Credits

Some assistance programs distribute funds monthly instead of annually. When broken down into monthly equivalents, tax credits or subsidies may resemble a steady income stream.

For example, families receiving certain refundable credits or housing assistance may see deposits that average around $725 per month over a specific period. These payments are conditional and depend on eligibility, compliance, and reporting requirements.

Experts warn that presenting these targeted benefits as a universal “monthly program” misleads the public.

The Role of Social Media in Amplifying Confusion

Digital platforms reward simplicity. Posts that mention a single number — especially a recurring payment — spread faster than nuanced explanations.

Once the $725 Monthly Program gained traction, algorithms amplified content related to it. Search engines then reflected that interest, creating a feedback loop where popularity appeared to confirm legitimacy.

Misinformation researchers say this pattern is increasingly common with financial topics. Even neutral curiosity can unintentionally boost misleading claims.

Public Concerns and Scam Risks

Consumer protection agencies report that spikes in interest around government payments often coincide with increased scam activity.

Fraudsters may impersonate government agencies, claiming that individuals must “verify” information to receive the $725 Monthly Program. These messages often arrive via text, email, or social media.

Officials emphasize that legitimate government agencies do not initiate contact through unsolicited messages asking for banking details, passwords, or fees.

Why January Magnifies Payment Myths

January combines several risk factors for misinformation:

- Heightened financial anxiety after holiday spending

- Anticipation of tax refunds

- Increased attention to household budgets

- New-year policy speculation

Experts say this environment makes people more receptive to claims about new income streams, especially when framed as government-backed.

Broader Debate: Cash Assistance in the U.S.

The attention around the $725 Monthly Program also reflects a deeper national conversation about cash assistance and economic security.

Supporters of guaranteed income argue that predictable cash payments can reduce financial stress, improve health outcomes, and provide flexibility. Critics question cost, scalability, and long-term effects on employment.

While no national program exists today, research and pilot programs continue to influence policy discussions at local and state levels.

What Americans Should Do

Financial experts advise several steps when encountering claims about new payment programs:

- Verify information through official government channels

- Look for program names, eligibility criteria, and administering agencies

- Be skeptical of posts that mention only a dollar amount

- Avoid sharing unverified claims

Clear information, experts say, is the strongest defense against confusion.

Looking Ahead

As economic pressures persist and discussions about income support continue, interest in programs like the $725 Monthly Program is likely to reappear in future search trends.

Unless federal policy changes, analysts expect similar spikes to be driven by local initiatives and online speculation rather than nationwide benefit expansions.

For now, officials stress that understanding the structure of government payments is essential to separating fact from fiction.

FAQs About $725 Monthly Program

Is the $725 Monthly Program real?

No universal federal program exists under that name.

Can some people receive $725 monthly payments?

Yes, through specific local or targeted programs with eligibility rules.

Why does my bank deposit say “federal”?

Many legitimate payments are labeled federally even if they are not new programs.