The $5000 Wells Fargo Settlement 2026 has become one of the most talked-about financial relief topics this year, especially among current and former Wells Fargo customers who believe they were affected by past banking misconduct. After years of investigations, lawsuits, and regulatory pressure, this settlement represents another major step toward compensating customers who experienced unauthorized accounts, improper fees, or loan-related issues. As new updates surface in 2026, many people are actively searching for clear answers about eligibility, payment amounts, and timelines. What makes the $5000 Wells Fargo Settlement 2026 especially important is the renewed focus on transparency. Earlier settlements left many customers confused about whether they qualified or why they received certain amounts. This time, clearer eligibility guidelines and payment schedules are helping customers better understand their rights and what actions, if any, they need to take.

Whether you had a checking account, auto loan, or mortgage with Wells Fargo, these updates could directly affect you. The $5000 Wells Fargo Settlement 2026 refers to a compensation program designed to address financial harm caused by Wells Fargo’s past banking practices. The $5,000 figure represents the maximum amount an eligible individual may receive, not a guaranteed payout for everyone. Payments are determined based on the severity of harm, duration of impact, and supporting records. The settlement covers a wide range of issues, including unauthorized account openings, incorrect fees, and loan servicing errors. With clearer rules now in place, customers can better assess whether they qualify and what level of compensation they might expect.

Table of Contents

$5000 Wells Fargo Settlement 2026

| Key Detail | Information |

|---|---|

| Settlement Name | $5000 Wells Fargo Settlement 2026 |

| Maximum Payment | Up to $5,000 |

| Eligible Customers | Impacted Wells Fargo account holders |

| Covered Issues | Unauthorized accounts, improper fees, loan errors |

| Payment Timeline | Throughout 2026 |

| Claim Requirement | Some automatic, some require claims |

| Payment Method | Direct deposit or mailed check |

The $5000 Wells Fargo Settlement 2026 offers financial relief to customers affected by past banking misconduct while reinforcing the importance of accountability in the financial sector. Although the process may feel complex, updated eligibility rules and clearer payment timelines have made it easier for customers to understand where they stand. By staying informed, reviewing personal records, and responding promptly to any settlement notices, eligible individuals can improve their chances of receiving the compensation they deserve. As payments continue throughout 2026, this settlement stands as a meaningful step toward restoring trust and fairness in banking.

Background Of the Wells Fargo Settlement

- The roots of this settlement trace back more than a decade. Wells Fargo faced widespread criticism after investigations revealed that employees had opened millions of customer accounts without authorization. These practices were often linked to aggressive sales targets that prioritized performance metrics over customer consent.

- Beyond unauthorized accounts, further reviews uncovered issues involving overdraft fees, mortgage servicing errors, and auto loan practices that resulted in unnecessary costs for customers. Regulatory agencies and courts responded with fines, enforcement actions, and settlement agreements. The 2026 settlement builds on these earlier actions, focusing on unresolved claims and customers whose financial harm may not have been fully addressed in previous compensation rounds.

Who Is Eligible for the Settlement

- Eligibility for the $5000 Wells Fargo Settlement 2026 depends on whether a customer experienced measurable financial harm connected to Wells Fargo’s misconduct. Generally, individuals who held checking, savings, credit, auto loan, or mortgage accounts during the affected periods may qualify.

- Eligible situations may include unauthorized account creation, improper overdraft or maintenance fees, incorrect loan charges, or credit score damage linked to these practices. Even customers who previously received compensation may be eligible for additional payments if new reviews identify further losses. Eligibility is assessed using internal bank records and, in some cases, customer-submitted documentation.

How The $5,000 Payment Amount Is Determined

- The $5,000 figure often causes confusion. It is not a flat payment and does not mean every eligible customer will receive the same amount. Instead, it represents the maximum possible compensation for individuals who experienced significant and prolonged financial harm.

- Payment amounts are calculated based on several factors. These include the type of misconduct involved, the financial impact on the customer, the length of time the issue remained unresolved, and whether the customer’s credit was affected. Minor fee-related issues may result in smaller payouts, while serious loan or credit-related harm may qualify for higher compensation under the settlement guidelines.

Payment Schedule And Distribution Timeline

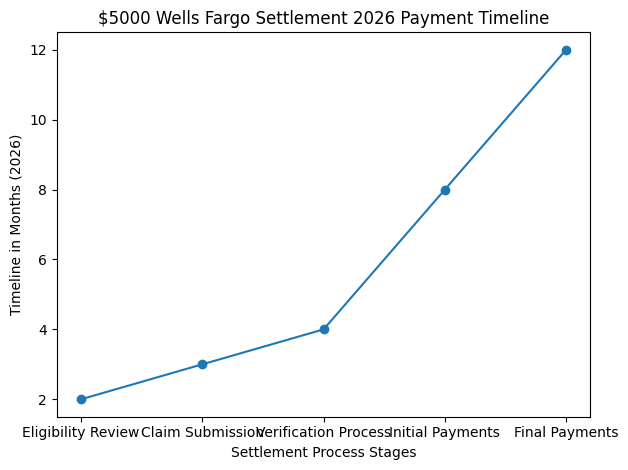

- One of the most searched aspects of the $5000 Wells Fargo Settlement 2026 is the payment schedule. According to current settlement updates, payments are expected to be distributed in stages throughout 2026 rather than all at once.

- Customers identified for automatic compensation may begin receiving payments earlier in the year. Those who are required to submit claims or additional documentation may see payments later, depending on verification timelines. While exact dates vary, most payments are expected to be completed by the end of 2026, barring unexpected delays.

How Payments Will Be Issued

- Settlement payments will typically be issued using the most reliable method available for each customer. Direct deposit is the preferred option when valid banking information is on file. Customers without updated account details may receive a paper check mailed to their last known address.

- It is important for eligible individuals to ensure their contact and banking information is accurate. Incorrect or outdated information can result in delayed or returned payments, extending the waiting period unnecessarily.

Do You Need to File a Claim

- Not all customers will need to file a claim to receive compensation under the $5000 Wells Fargo Settlement 2026. In many cases, Wells Fargo already has sufficient records to identify affected customers and issue payments automatically.

- However, some individuals may be required to submit a claim, especially if their account was closed, their records are incomplete, or their situation involves disputed details. Claim notices typically include clear instructions and deadlines. Missing a deadline could result in losing eligibility, making it essential to review all settlement communications carefully.

What Customers Should Do Now

- If you believe you may qualify for compensation, taking proactive steps can help ensure you do not miss out. Reviewing past account statements, loan agreements, and credit reports can help identify issues that fall under the settlement. Keeping copies of relevant documents may also be useful if a claim is required.

- Customers should watch for official notices and ensure their contact information is current. Staying informed is one of the most effective ways to navigate the $5000 Wells Fargo Settlement 2026 process smoothly.

Why This Settlement Matters In 2026

- The $5000 Wells Fargo Settlement 2026 is significant not only because of the compensation involved, but also because it highlights ongoing efforts to hold large financial institutions accountable. For many customers, this settlement represents long-awaited acknowledgment of financial harm that disrupted their personal finances.

- In 2026, consumer protection remains a major focus in the banking industry. This settlement serves as a reminder that regulatory oversight and customer advocacy can lead to meaningful outcomes, even if the process takes time.

Common Misunderstandings About The Settlement

- One common misconception is that every Wells Fargo customer will receive $5,000. In reality, only those who experienced qualifying harm are eligible, and payment amounts vary. Another misunderstanding is that all customers must file a claim. Many payments are automatic, though some situations require additional action.

- Understanding these distinctions can help manage expectations and reduce confusion as payments are rolled out.

FAQs on $5000 Wells Fargo Settlement 2026

Who qualifies for the $5000 Wells Fargo Settlement 2026

Customers who experienced financial harm due to unauthorized accounts, improper fees, or loan-related errors may qualify.

Will everyone receive $5,000

No. The $5,000 amount is the maximum possible payout. Actual payments depend on individual circumstances.

Do I need to submit a claim

Some customers will be paid automatically, while others may need to file a claim if notified.

How will I receive my settlement payment

Payments will be issued via direct deposit or mailed check, depending on the information on file.