The USA Minimum Wage Increase 2026 is shaping up to be one of the most important labor updates in recent years. As January 2026 arrives, millions of workers across the country will see higher hourly pay, thanks to state-level wage laws that have been years in the making. With inflation continuing to affect everyday expenses like rent, groceries, and transportation, these increases are arriving at a critical time. The USA Minimum Wage Increase 2026 is not just a policy update; it directly affects household budgets, workforce stability, and business planning nationwide. For many Americans, minimum wage work is not a temporary phase but a long-term reality. That’s why the USA Minimum Wage Increase 2026 matters beyond headlines. While the federal minimum wage remains unchanged, states are stepping in to address economic pressure and cost-of-living challenges. Understanding how these changes work, who they impact, and what comes next can help both workers and employers prepare for the year ahead.

The USA Minimum Wage Increase 2026 is not a single nationwide raise but a collection of scheduled state and local wage increases taking effect at the beginning of the year. Many of these changes were approved years ago through legislation or voter-backed initiatives and are now reaching their final implementation phase. Several states also use inflation-based formulas, meaning wages rise automatically as prices increase. This results in noticeable differences in minimum wage rates from one state to another. As of January 2026, more than a dozen states will have minimum wages at or above $15 per hour. Others fall slightly below but still remain far higher than the federal minimum. This decentralized approach reflects how states are increasingly taking responsibility for wage policy in the absence of federal action. For workers, it means higher earnings in many regions. For employers, it means staying informed and compliant with location-specific wage laws.

Table of Contents

USA Minimum Wage Increase 2026

| Category | Details |

|---|---|

| Effective Date | January 1, 2026 |

| Federal Minimum Wage | $7.25 per hour |

| Highest State Minimum Wage | Over $17 per hour |

| States Increasing Wages | More than 15 states |

| Main Reason for Increase | Inflation adjustments and phased laws |

| Estimated Workers Impacted | Over 8 million |

The USA Minimum Wage Increase 2026 represents a major shift in how wages are addressed across the country. While the federal minimum wage remains unchanged, state-led initiatives are providing higher pay for millions of workers. These changes reflect evolving economic realities and a growing focus on wage sustainability. Whether you are a worker planning your finances or an employer preparing for compliance, staying informed about minimum wage laws is essential as 2026 unfolds.

Federal Minimum Wage Status In 2026

- Despite widespread wage growth at the state level, the federal minimum wage remains at $7.25 per hour in 2026. This rate has not changed since 2009, making it increasingly disconnected from today’s economic reality. Over the years, inflation has reduced the purchasing power of this wage, leaving many full-time workers struggling to cover basic living expenses.

- Because of this gap, states have taken the lead in raising wages. Employers are legally required to pay the highest applicable wage, whether federal, state, or local. In states that have not set their own minimum wage, the federal rate still applies. However, the number of workers relying solely on the federal minimum wage continues to decline as more states adopt higher standards.

States Implementing Minimum Wage Increases In 2026

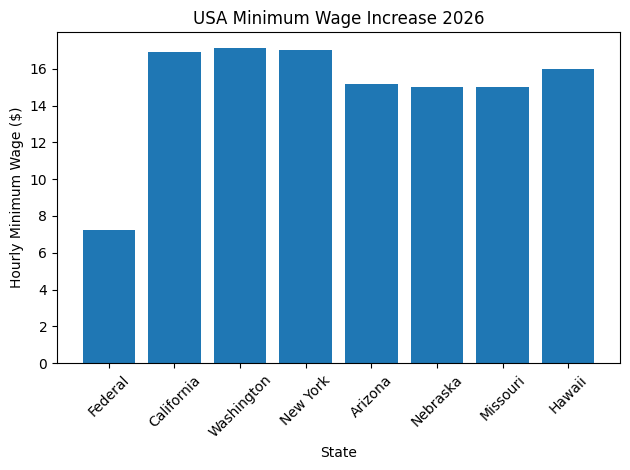

- A significant part of the USA Minimum Wage Increase 2026 comes from states that passed long-term wage plans years ago. These plans often involved gradual increases to avoid sudden financial strain on businesses. States such as California, Washington, and New York continue to lead with some of the highest minimum wages in the country, particularly in high-cost urban areas.

- Other states, including Nebraska, Missouri, and Arizona, are reaching the $15 per hour threshold for the first time in 2026. This milestone reflects changing attitudes toward wage fairness and economic sustainability. Some states also maintain tiered systems where wages vary by region or business size. These tailored approaches aim to balance worker needs with local economic conditions.

Why Minimum Wages Are Rising Now

- The timing of the USA Minimum Wage Increase 2026 is closely linked to rising living costs and long-term economic trends. Housing, healthcare, childcare, and transportation costs have all increased significantly over the past decade. Many lawmakers and voters recognized that stagnant wages were no longer sustainable, leading to policies that gradually raised minimum pay.

- Inflation-based wage adjustments also play a major role. In states that link wages to inflation, increases occur automatically when the cost of living rises. This approach helps prevent wages from falling behind again in the future. By 2026, many of these policies are reaching full implementation, making this year a major turning point for wage growth.

Impact On Workers and Households

- For workers earning close to minimum wage, the USA Minimum Wage Increase 2026 can translate into thousands of extra dollars annually. Higher hourly pay can reduce financial stress, improve access to healthcare, and help families manage everyday expenses more effectively. For single parents, students, and part-time workers, even a small hourly increase can make a noticeable difference.

- Higher wages are also linked to improved job satisfaction and lower turnover. When workers feel fairly compensated, they are more likely to stay with their employer and perform better. Over time, this can lead to more stable households and stronger local economies. While higher wages alone do not solve all economic challenges, they provide a meaningful step toward financial security for many families.

Impact On Employers and Businesses

- For businesses, especially small and mid-sized ones, the USA Minimum Wage Increase 2026 requires careful planning. Employers must update payroll systems, review labor budgets, and ensure compliance with new wage laws. Failure to comply can result in penalties and legal issues, making preparation essential.

- While higher wages increase labor costs, many businesses also experience benefits. Improved employee retention reduces hiring and training expenses. Higher pay can attract more qualified applicants and boost morale. Some businesses respond by investing in technology, improving efficiency, or adjusting pricing strategies. In many cases, the long-term benefits of a more stable workforce help offset the initial costs.

What Comes Next After 2026

- The USA Minimum Wage Increase 2026 is not the end of wage growth in the United States. Several states already have laws in place that will continue raising minimum wages beyond 2026. Others will keep adjusting wages annually based on inflation. This means minimum wage changes are likely to remain a regular part of the economic landscape.

- At the federal level, discussions about raising the national minimum wage continue, though no confirmed changes are scheduled. Future wage policies will likely depend on economic conditions, political priorities, and public opinion. For now, state-led action remains the primary driver of wage increases across the country.

FAQs on USA Minimum Wage Increase 2026

Will The Federal Minimum Wage Increase In 2026

No, the federal minimum wage remains at $7.25 per hour in 2026. All increases taking effect are the result of state or local laws.

Which States Have the Highest Minimum Wages In 2026

States such as Washington and California, along with certain regions in New York, have the highest minimum wages, with rates exceeding $16 per hour.

Who Benefits Most from the USA Minimum Wage Increase 2026

Low-income workers in industries like retail, food service, healthcare support, and hospitality benefit the most from the wage increases.

Do Small Businesses Have to Follow the New Minimum Wage Laws

Yes, most small businesses must comply with state and local minimum wage laws unless a specific exemption applies.