Claims that $2000 Payments began automatically on January 1 have spread widely online, but U.S. tax officials say no such universal program exists. The Internal Revenue Service has confirmed that while some taxpayers may receive refunds or credits totaling around $2,000 this year, those payments stem from existing tax law, not a newly authorized stimulus initiative.

Table of Contents

$2000 Payments

| Key Fact | What It Means |

|---|---|

| No new $2000 Payments program | IRS confirms no automatic or universal payments |

| $2000 figure tied to tax credits | Amount often reflects Child Tax Credit or refunds |

| Congress must approve stimulus | IRS cannot issue payments without legislation |

| Tax season drives confusion | Refund estimates often mistaken for stimulus |

| Scams increase during tax season | Fraudsters exploit viral payment claims |

What the IRS Says About $2000 Payments

The Internal Revenue Service (IRS) has not announced any new nationwide program issuing automatic $2000 payments to Americans. Agency officials say recent claims suggesting such payments began at the start of the year are inaccurate and risk misleading taxpayers.

In public statements and updated guidance, the IRS has emphasized that any broad stimulus-style payment would require explicit authorization from Congress and the signature of the president. No such legislation has been passed.

“The IRS does not have authority to issue payments without a law directing it to do so,” the agency said in a recent clarification addressing widespread online reports about $2000 Payments.

This position reflects long-standing legal constraints on the agency. The IRS administers tax laws enacted by Congress but does not create new benefit programs on its own. During the COVID-19 pandemic, for example, stimulus checks were authorized only after Congress passed emergency relief legislation specifying payment amounts, eligibility rules, and funding sources.

Why the $2000 Figure Keeps Appearing

Despite the lack of a new program, the $2000 amount continues to surface in headlines and social media posts. Tax analysts say the figure is familiar because it mirrors the maximum value of certain existing tax benefits.

Chief among them is the Child Tax Credit, which provides up to $2,000 per qualifying child under current law, subject to income thresholds and phaseouts. For eligible families, the credit can significantly increase a refund or reduce taxes owed.

Another contributor is the Earned Income Tax Credit (EITC), a refundable credit aimed at low- and moderate-income workers. Depending on household size and income, the EITC can add thousands of dollars to a refund, even if no federal income tax is owed.

“These are annual features of the tax system,” said Elaine Maag, a senior fellow at the Urban Institute who studies tax policy. “They are not new payments, and they are not automatic. Eligibility depends on income, family structure, and filing status.”

Tax Refunds Versus Stimulus Payments

A central source of confusion lies in the distinction between tax refunds and stimulus payments. Refunds represent a reconciliation between taxes owed and taxes paid during the year. If too much was withheld from paychecks, the taxpayer receives the excess back.

Stimulus payments, by contrast, are direct government benefits designed to inject money into the economy, regardless of tax liability. These payments require separate legislative approval and are typically issued during periods of economic crisis.

“Refunds are your own money coming back to you,” said Howard Gleckman, a senior fellow at the Tax Policy Center. “Stimulus checks are government outlays. Conflating the two creates misunderstanding.”

During the pandemic, many Americans became accustomed to receiving stimulus checks automatically, often without filing a return first. That experience has shaped expectations, even though no comparable program is currently in place.

How Misinformation Gains Traction

Experts say the rapid spread of claims about $2000 Payments reflects broader trends in online news consumption. Sensational headlines, algorithm-driven platforms, and financial anxiety can amplify unverified or misleading information.

Some websites republish vague or recycled content that mimics official announcements without citing primary sources. Others frame speculative policy ideas as confirmed actions, blurring the line between proposal and law.

“This is a recurring pattern every tax season,” said Kimberly Clausing, a UCLA economist and former Treasury official. “People are looking for relief, and misleading stories spread faster than careful explanations.”

The IRS and Treasury Department rarely announce major policy changes quietly. Historically, stimulus programs have been accompanied by formal press releases, congressional votes, and extensive coverage from major news organizations.

The “Tariff Dividend” and Other Proposals

Some reports linking $2000 Payments to January have referenced a proposed “tariff dividend,” an idea discussed publicly by political figures as a way to distribute revenue from import tariffs to households.

While such proposals have been mentioned in speeches and interviews, they have not been enacted into law. No funding mechanism has been approved, and no administrative framework exists to implement such payments.

Policy experts stress that proposals alone have no legal effect.

“Until something passes both chambers of Congress and is signed into law, it is simply a concept,” said Gleckman. “The IRS cannot act on concepts.”

When the IRS Is Actually Sending Money

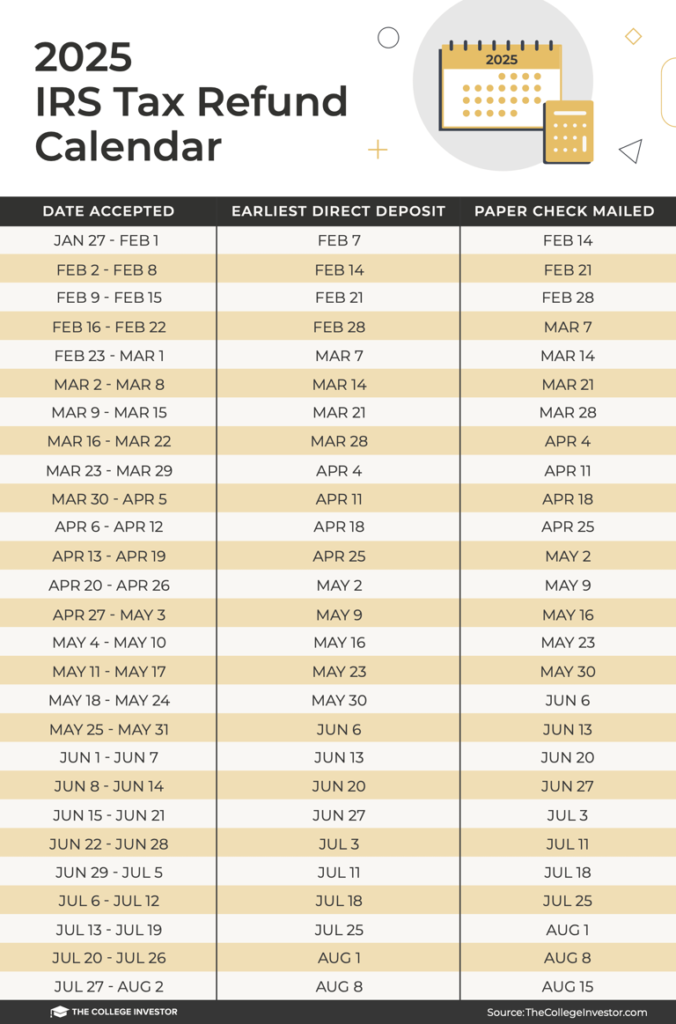

The IRS does send money to taxpayers every year through the regular tax filing process. The agency typically begins accepting and processing federal returns in late January, after finalizing updates to forms and systems.

Refund timing depends on several factors:

- Whether the return is filed electronically or on paper

- Whether direct deposit is selected

- Whether the return claims refundable credits subject to review

Under federal law, refunds that include the Earned Income Tax Credit or the refundable portion of the Child Tax Credit cannot be issued until mid-February at the earliest, due to anti-fraud provisions.

Most taxpayers who file electronically and choose direct deposit receive refunds within 21 days, according to IRS estimates.

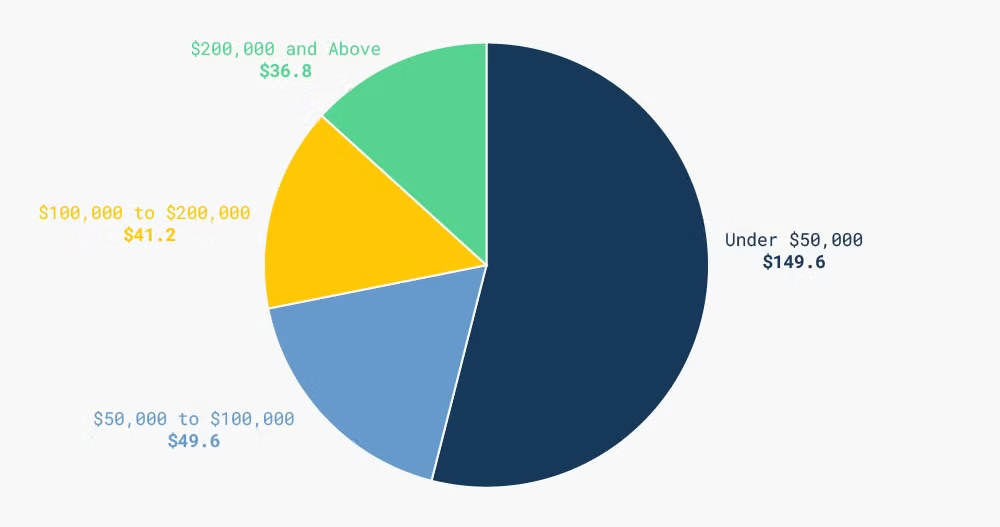

Who Is Most Likely to Receive a $2000-Level Refund

While no universal $2000 Payments exist, some groups are statistically more likely to see refunds around that amount. These include:

- Families with one qualifying child and moderate income

- Workers eligible for the Earned Income Tax Credit

- Taxpayers whose employers overwithheld federal taxes

However, refunds vary widely based on individual circumstances. Filing status, income fluctuations, and changes in family size can all affect outcomes from year to year.

Tax professionals caution against planning household finances around assumed refund amounts.

“A refund is not guaranteed income,” said Nina Olson, former National Taxpayer Advocate. “It is a reconciliation that can change unexpectedly.”

Scams and Consumer Risks

The IRS has warned repeatedly that false claims about $2000 Payments create fertile ground for scams. Fraudsters often impersonate government agencies, promising fast payments in exchange for personal or banking information.

Common red flags include:

- Messages claiming urgent action is required

- Requests for Social Security numbers via text or email

- Links to non-government websites mimicking IRS branding

The IRS says it does not initiate contact through social media, text messages, or unsolicited emails regarding payments.

Historical Context: Why Stimulus Checks Are Unlikely Now

Economists note that previous stimulus programs were enacted during periods of acute economic distress, including the 2008 financial crisis and the COVID-19 pandemic.

Current economic conditions, while challenging for many households, differ significantly from those emergencies. Employment levels, consumer spending, and government finances all factor into lawmakers’ decisions.

“Stimulus checks are extraordinary measures,” said Clausing. “They are not part of normal fiscal policy.”

That does not preclude future relief measures, but it underscores why no automatic payments should be assumed without clear legislative action.

What Happens Next

Absent new legislation, the only $2000 Payments Americans may see will come through regular tax refunds and existing credits. Congress continues to debate tax policy changes, but no bill authorizing new direct payments has advanced.

The IRS advises taxpayers to rely on official guidance and to consult qualified tax professionals if unsure about eligibility or refund expectations.

For now, officials say accuracy and caution matter more than ever as tax season approaches.

FAQ

Are $2000 Payments automatic?

No. There is no automatic or universal $2000 payment program.

Can I receive $2000 from the IRS this year?

Possibly, but only through refunds or credits you qualify for under existing law.

Is a new stimulus check coming?

There is no approved legislation authorizing a new stimulus payment.

How can I verify IRS information?

Use IRS.gov or coverage from established national news organizations.