The Social Security Administration (SSA) has announced that eligible retirees will receive a $2,969 monthly payment starting January 21, 2026. This figure represents the maximum possible benefit for those starting retirement benefits at age 62 in 2026. To help recipients understand how they can qualify for this amount, we provide an in-depth look at eligibility criteria, the payment timeline, and the broader implications for retirees.

Table of Contents

$2,969 Per Month SSA Retirement Payment

| Key Fact | Detail/Statistic |

|---|---|

| Maximum Monthly Payment | $2,969 for retirees starting benefits at age 62 in 2026. |

| Eligibility | Must have at least 40 work credits and a high earnings history. |

| Payment Date | January 21, 2026, for recipients born between the 11th and 20th. |

| Cost-of-Living Adjustment (COLA) | 2.8% increase in 2026. |

With the projected rise in cost-of-living adjustments and changes to the maximum benefit thresholds, it is crucial for future retirees to be mindful of their Social Security planning. By understanding how the system works, especially factors like claiming age and earnings history, individuals can make informed decisions to maximize their benefits.

For those planning to rely on Social Security as a primary source of retirement income, the $2,969 maximum payment in 2026 is an essential benchmark. Understanding eligibility requirements and the impact of inflation adjustments will help beneficiaries better plan their financial future.

Understanding the $2,969 Social Security Retirement Payment in 2026

The $2,969 figure represents the maximum Social Security retirement payment available to individuals who begin claiming benefits at age 62 in 2026. Social Security payments are tied to an individual’s earnings history, with the highest possible benefits available to those who have contributed to Social Security at the maximum taxable earnings for 35 years.

Eligibility Criteria

To qualify for Social Security retirement benefits, individuals must earn at least 40 credits, which typically equates to about 10 years of work. These credits are earned by paying into the Social Security system through FICA taxes during employment. For the maximum benefit of $2,969, individuals must also have high lifetime earnings, having earned at or above the maximum taxable earnings limit for many years. This maximum taxable earnings figure changes annually.

How the $2,969 is Calculated

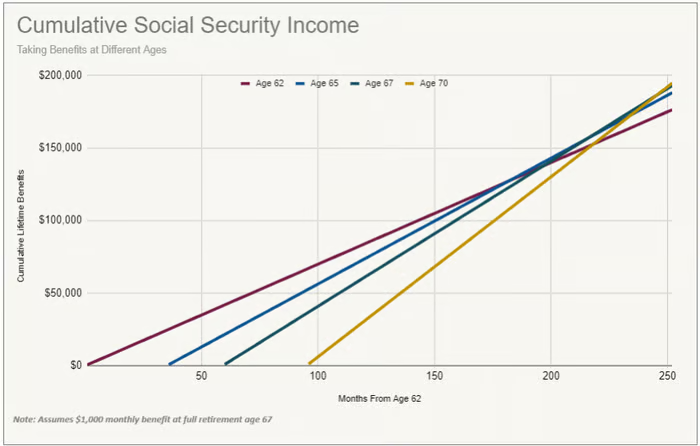

The Social Security Administration calculates your monthly benefit based on your average indexed monthly earnings (AIME), which is a measure of your highest earning years, adjusted for inflation. The $2,969 figure applies only to those who reach the maximum AIME threshold and begin claiming benefits at age 62. It’s important to note that starting benefits at a later age—such as age 66 or 70—can significantly increase the monthly payout due to delayed retirement credits.

What Does the 2026 Payment Date Mean for You?

For Social Security recipients, payment dates are determined by their birthday. Those born between the 11th and 20th of the month will receive their payment on January 21, 2026. This is part of the SSA’s rolling payment schedule, which ensures that benefits are distributed efficiently throughout the month based on the birth date.

Cost-of-Living Adjustments (COLA)

Social Security benefits are subject to annual adjustments for inflation, known as Cost-of-Living Adjustments (COLA). For 2026, beneficiaries will see a 2.8% increase in their benefits, which will directly affect the $2,969 figure. The COLA is calculated based on the Consumer Price Index (CPI), which measures the average change in prices for goods and services most commonly purchased by retirees.

Why Is This Payment Important for Retirees?

The $2,969 maximum benefit represents a substantial portion of income for many retirees, but it is important to recognize that most recipients will not receive this amount. According to Social Security Administration data, the average monthly benefit for retirees in 2026 is expected to be closer to $1,800. The disparity highlights how crucial a high lifetime earnings record is for maximizing Social Security benefits.

For many retirees, Social Security remains a primary source of income, especially for those who have limited access to pension plans or other retirement savings. As the cost of living continues to rise, the 2.8% COLA increase is a vital adjustment to help retirees maintain their purchasing power.

The Growing Need for Social Security Planning

As people live longer, the need for careful retirement planning has never been more pressing. With longer life expectancies, many Americans will spend decades in retirement, and Social Security benefits play a crucial role in ensuring financial security. The average age for retirement continues to rise, making it important for people to plan early, understanding how their work history and claiming age affect the Social Security payments they will receive.

What Other Factors Affect Your Social Security Payments?

In addition to work history and earnings at the maximum taxable level, several other factors can affect the amount of Social Security benefits one receives.

Full Retirement Age (FRA):

The full retirement age is 66 years and 2 months for those born in 1960 or later. Individuals who claim at their FRA receive their full benefit amount, but waiting until age 70 can increase monthly payments by up to 8% per year. This can result in significant increases in monthly checks, potentially adding thousands of dollars over the course of a retiree’s lifetime.

Earnings History:

The earnings record plays a significant role in determining benefits. Individuals with a long, consistent history of high earnings are most likely to receive the maximum benefit, while those with lower lifetime earnings will receive proportionately lower benefits. To get a better understanding of how your earnings are factored into Social Security, you can access a personalized estimate of your benefits through the SSA website.

Family Benefits:

Some family members may also be eligible for spousal or dependent benefits, which can further enhance household income. These benefits are calculated based on the primary wage earner’s earnings record. For example, a spouse can receive up to 50% of the primary earner’s benefit at full retirement age, potentially increasing household retirement income. Understanding these rules can be key to maximizing the overall Social Security payout for a family.

Social Security and Taxes: What to Know

While Social Security benefits provide crucial financial support during retirement, recipients should be aware that these benefits are subject to income taxes. The amount of your benefits that are taxable depends on your total income, including wages, pensions, and other retirement income sources.

For most beneficiaries, up to 85% of their Social Security benefits may be taxable, depending on the amount of their combined income. Combined income is calculated by adding together your adjusted gross income (AGI), any nontaxable interest, and half of your Social Security benefits.

Social Security Benefits and Healthcare Costs

Another critical factor for retirees is the impact of healthcare expenses. Most retirees are eligible for Medicare, which covers many healthcare needs but does not cover everything. Retirees often face out-of-pocket costs for prescription drugs, dental care, and long-term care, which can reduce their effective monthly income from Social Security.

While the Medicare premium is deducted directly from Social Security checks, beneficiaries should still plan for additional healthcare costs. For 2026, the Part B premium (which covers doctor visits, outpatient care, and other services) is expected to rise, which could impact the net amount that beneficiaries receive.

What Lies Ahead for Social Security Recipients?

Social Security faces long-term financial challenges due to an aging population and shifting demographics. With the number of beneficiaries expected to increase as baby boomers retire, there are concerns about the program’s sustainability in the coming decades. However, it is important to note that Social Security is not in danger of running out of funds in the immediate future. The trust funds that support the program are expected to be sufficient to cover full benefits until approximately 2034. After that, the system may be able to pay only about 80% of benefits without reforms.

In the face of these challenges, it is likely that policymakers will continue to debate potential reforms to ensure the program’s long-term viability, though it remains unclear what changes may be implemented.

FAQs About $2,969 Per Month SSA Retirement Payment

Q: What is the earliest age I can start receiving Social Security benefits?

A: The earliest age to begin receiving Social Security benefits is 62. However, claiming benefits before full retirement age may result in reduced monthly payments.

Q: How much will my Social Security payment be?

A: The amount depends on your lifetime earnings. In 2026, the maximum payment for someone who starts benefits at age 62 will be $2,969, though most people will receive a lower amount.

Q: Will the 2026 Social Security payments increase over time?

A: Social Security payments are subject to Cost-of-Living Adjustments (COLA), which help keep pace with inflation. In 2026, beneficiaries will see a 2.8% increase in their payments.